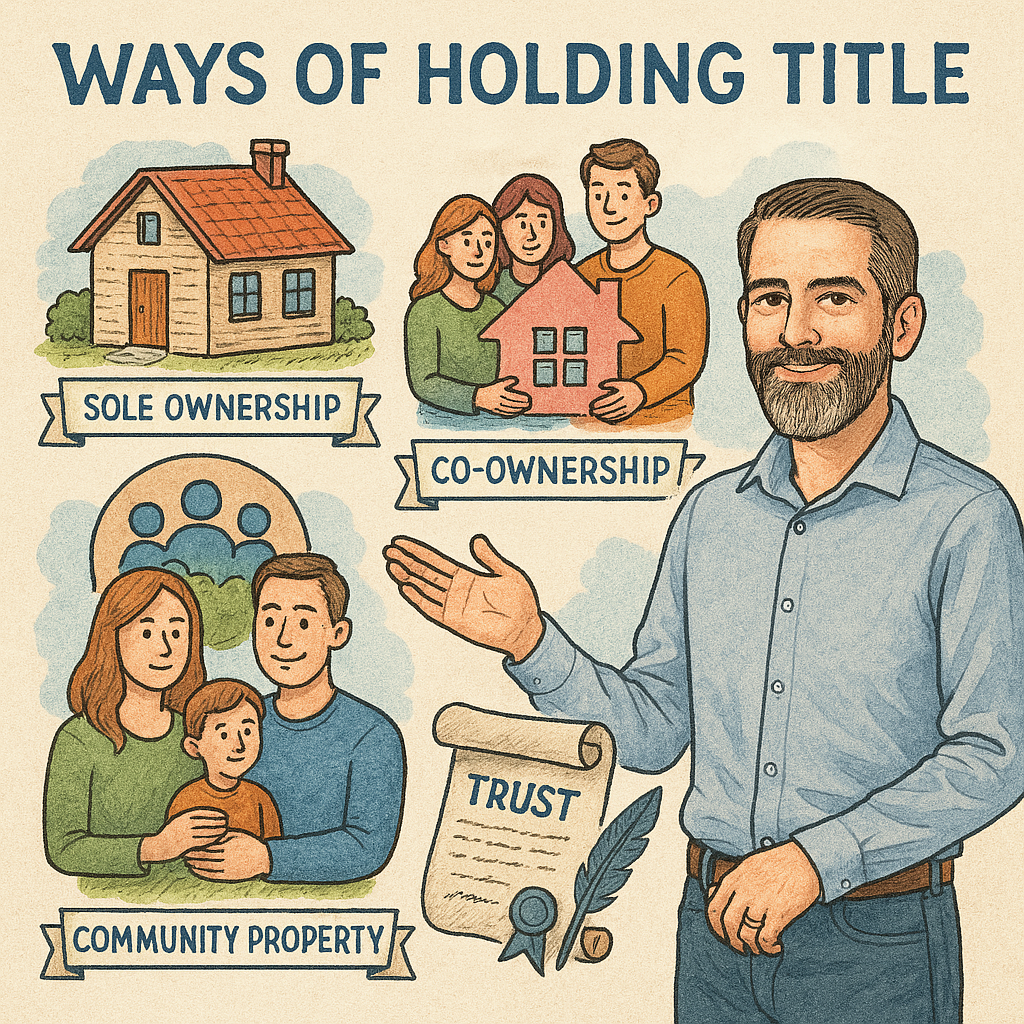

HOME BUYING GUIDE: COMMON WAYS OF HOLDING TITLE

When buying a home, a vital decision is determining how to hold the title. This choice can impact everything from legal rights to tax obligations and inheritance plans.

While it's essential to consult with a trusted attorney or CPA to navigate these choices, understanding the basics can help you start on the right foot.

Choosing how to hold the title of your new home is a pivotal decision affecting legal rights, taxation, and estate planning. Common options include sole ownership, various co-ownership methods, and trust ownership, each offering unique advantages and considerations.

Consulting with legal or financial advisors is crucial to align your choice with personal goals and avoid potential pitfalls.

- 🧑⚖️ Sole ownership gives full control but lacks creditor protection and probate avoidance.

- 👫 Community Property is favored among California couples, sharing ownership equally.

- 🤝 Community Property with Right of Survivorship avoids probate, smoothly transferring ownership upon death.

- 👥 Joint Tenancy allows automatic property transfer to survivors but may have tax downsides.

- 🔗 Tenancy in Common permits varied ownership shares, but doesn't automatically transfer ownership upon death.

- 📝 Trust ownership helps avoid probate and offers estate planning flexibility, but can be costly to set up and manage.

- 🔍 Get professional advice to ensure your choice aligns with long-term estate and tax goals.

Sole ownership, as the name suggests, is when a single individual or entity holds title to a property. This form offers flexibility and control, perfect for individuals who prefer making decisions independently.

- Pros of Sole Ownership: - Full control over property decisions without needing approval from others. - No additional setup costs compared to some co-ownership forms.

- Cons of Sole Ownership: - Limited tax benefits compared to co-ownership methods that offer step-up basis. - No built-in protection against creditors or probate costs upon the owner's death.

Tip for Homebuyers: Consider your long-term estate planning needs. Without a will or trust, your property might not be distributed according to your wishes after your death.

Co-ownership methods allow two or more individuals to share interests in a property. Common forms include Community Property, Community Property with Right of Survivorship, Joint Tenancy, and Tenancy in Common.

- Community Property: This is common among married couples or registered domestic partners in California. Each partner has an equal share, and upon one's death, you can choose how their share is distributed via a will.

- Community Property with Right of Survivorship: Offers the tax benefits of community property while seamlessly transferring ownership to the other partner upon death, thus avoiding probate.

- Joint Tenancy: Known for its right of survivorship which automatically transfers ownership to remaining tenants upon death. However, may have less favorable tax implications.

- Tenancy in Common: Allows varying ownership shares among multiple owners and differs from joint tenancy in that the deceased's share does not automatically transfer to other owners and may need to go through probate.

Tip for Homebuyers: Assess each option with regard to future plans, taxes, and legal implications by consulting with professionals, as incorrect decisions can lead to tax penalties and probate costs later on.

Trust ownership, particularly through a California Revocable Living Trust, provides a strategic way to manage property efficiently by avoiding probate, thus reducing costs and providing estate planning flexibility.

- Advantages: - Avoids the lengthy and expensive probate process. - Offers enhanced control over how and when your assets are distributed.

- Considerations: - Setting up a trust can be expensive and requires ongoing management. - Measuring potential tax benefits necessitates professional counsel.

Tip for Homebuyers: Consider a trust if privacy, tax savings, and smooth inheritance transitioning are significant aspects of your estate planning.

- Legal and Tax Implications: Each method comes with unique tax benefits, legal rights, and creditor protection levels.

- Estate Planning: Consider future heirs, probate avoidance, and tax obligations when choosing your method of ownership.

- Professional Advice: Engage with legal and financial advisors to make informed, customized decisions suited to your specific scenario.

More information can be found through the California Land Title Association or by consulting qualified legal and financial advisors to tailor your decisions according to specific needs.